Solar Water Heater Tax Credit 2017

See below for more information.

Solar water heater tax credit 2017. The credit had expired at the end of 2017. The water must be used in the dwelling. Tax credits for home improvements that expired in 2017 were retroactively extended through december 31 2020. For all other technologies the credit is not available for systems whose construction commenced after december 31 2016.

2017 residential energy tax credit rates. Wind facilities commencing construction by december 31 2019 can qualify for this credit the value of the credit steps down in 2017 2018 and 2019. At least half of the energy generated by the qualifying property must come from the sun. In other words a tax credit that exists today for say replacing your hot water heater with a solar water heating system might not exist next year or.

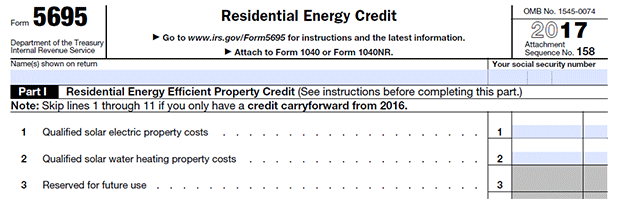

Under the bipartisan budget act of 2018 the renewable energy tax credits for fuel cells small wind turbines and geothermal heat pumps now feature a gradual step down in the credit value the same as those for solar energy systems. Taxpayers who upgrade their homes to make use of renewable energy may be eligible for a tax credit to offset some of the costs. Federal income tax credits and other incentives for energy efficiency. Most taxpayers will need to file their 2018 form 5695 with an amended return form 1040 x to claim the nonbusiness energy property credit for 2018.

You will need to filter by solar once you open the water heaters product list. Tax credits for residential energy efficiency have now been extended retroactively through december 31 2020. Qualified solar water heating property costs are costs for property to heat water for use in your home located in the united states if at least half. 2017 federal solar tax credit.

Solar space heating passive or active 0 60 per first year energy yield in kwh up to 1 500. The tax credit for builders of energy efficient homes and tax deductions for energy efficient commercial buildings have also been retroactively extended through december 31 2020. The credit is not available for expenses for swimming pools or hot tubs. Qualifying properties are solar electric property solar water heaters geothermal heat pumps small wind turbines and fuel cell property.

Through the 2020 tax year the federal government offers the nonbusiness energy property credit. Here are the requirements for solar water heaters and solar panels photovoltaic systems as listed on the energy star website. Renewable energy tax credits. Solar domestic water heating 2 00 per first year energy yield in kwh up to 6 000 solar.

Those currently in place for 2019 might change in the future as well. Claim the credits by filing form 5695 with your tax return. Only fuel cell property is subject to a limitation which is 500 with respect to each half kilowatt of capacity of the qualified fuel cell property. File tax form 5695 with your tax return.