Solar Water Heater Depreciation Rate

V solar water heaters and systems vi solar crop drivers and systems vii solar steels and desalination systems viii solar refrigeration air conditioning systems and cold storages ix solar pumps based on solar photovoltaic and solar thermal conversion x solar power generating systems xi solar photovoltaic panels and modules for.

Solar water heater depreciation rate. Depreciation allowance as percentage of written down value. Water heaters including small steam boilers up to 500kw 10 years. Heating chambers including coils and heat exchangers 12 years. For the most up to data effective lives go to the ato effective lives section under the depreciation schedules menu dropdown.

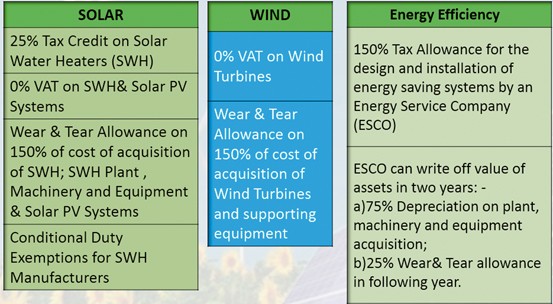

Photovoltaic electricity generating system assets incorporating photovoltaic panels mounting frames and inverters. Block of assets. Ays 2003 04 to 2005 06. Allowing businesses to deduct the depreciable basis over five years reduces tax liability and accelerates the rate of return on a solar investment.

1 0 crore per year rs. The maximum you can elect to deduct for most section 179 property you placed in service in tax years beginning in 2019 is 1 020 000 1 055 000 for qualified enterprise zone property. It is considered part of the plumbing system which is depreciated over 27 5 years. This implies that the user will be able to claim tax benefit of 30 of 5 of rs.

Below are the ato effective lives for residential property as at the 1st of july 2017 from. 2 19 750 two lakh nineteen thousand seven hundred and fifty only what would be the current value. Increased section 179 deduction dollar limits. 1 5 lakh per year for next 20 years.

Ato depreciation rates 2020 table a. Ato depreciation effective lives 2017 2018 tr 2017 2 note. For purpose of income tax. Under normal circumstances the user will be able to claim an annual depreciation of 5 of rs.

Accelerated depreciation encourages private sector investment. The effective life legsilation has been updated. Boilers see table b boilers. Electricity supply 26110 to 26400.

Rates of depreciation for income tax as applicable from the assessment year 2003 04 onwards. Macrs depreciation is an important tool for businesses to recover certain capital costs over the property s lifetime. I have purchased a solar water heating system on 20 06 2007 for rs. If it needs to be replaced before 27 5 years then you would get the rest of the deduction when it is disposed of.

Electricity gas water and waste services 26110 to 29220. 1 0 crore considering linear depreciation 100 20yr 5 yr.