Solar Power Tax Credit 2020

You might be eligible for this tax credit inspection costs and developer fees.

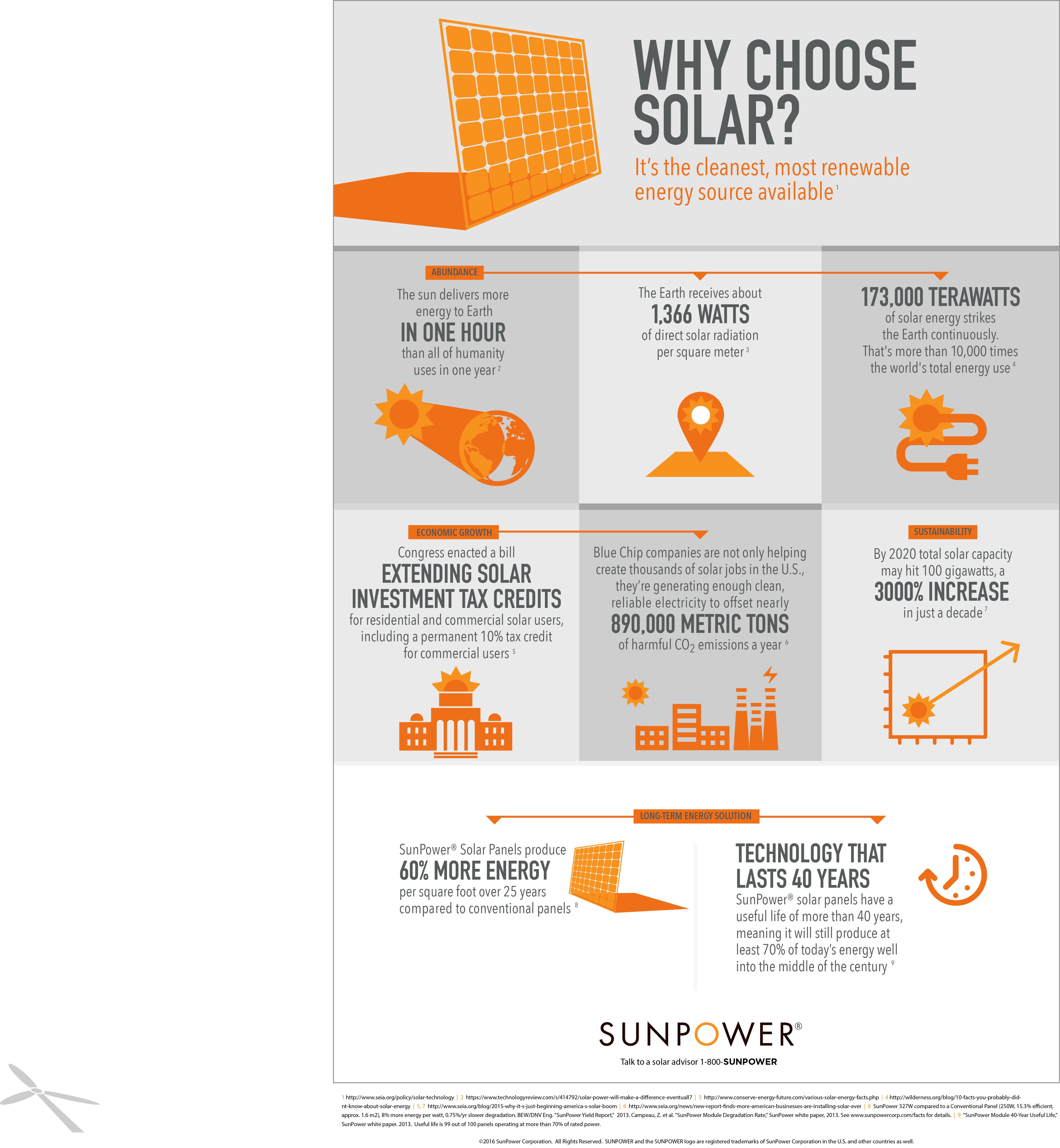

Solar power tax credit 2020. The tax credit remains at 30 percent of the cost of the system. The residential energy credits are. What does the federal solar tax credit extension mean for the solar industry. Information about form 5695 residential energy credits including recent updates related forms and instructions on how to file.

22 for systems installed in 2021. Solar energy technologies and the tax credit expires starting in 2022 unless congress renews it. At that price the solar tax credit can reduce your federal tax burden by 4 618 and that s just one of many rebates and incentives that can reduce the cost of solar for homeowners. Owners of new residential and commercial solar can deduct 26 percent of the cost of the system from their taxes.

If you end up with a bigger credit than you have income tax due a 3 000 credit on a 2 500 tax bill for instance you can t use the credit to get money back from the irs. To claim the credit you must file irs form 5695 as part of your tax return. How does the federal solar tax credit work. There s plenty of.

There is no maximum amount that can be claimed. According to energysage marketplace data the average national gross cost of installing a solar panel system in 2020 is 17 760. The credit for that system would be 26 of 16 080 or 4 180. Am i eligible to claim the federal solar tax credit.

Owners of new residential and commercial solar can deduct 22 percent of the cost of the system from their taxes. 30 of the costs of equipment permits and installation can be claimed back via your federal tax return. Filing requirements for solar credits. If say your federal taxes are 6 000 for 2020 and you re eligible for a 7 000 tax credit for installing a solar system at your house you can claim the leftover 1 000 as a credit toward your.

A series of extensions pushed the expiration date back to the end of 2016 but experts believed that an additional five year extension would bring the. Owners of new commercial solar energy systems can deduct 10. Throughout 2020 the solar tax credit is equal to 26 percent of the cost to install a solar system. The federal solar energy tax credit is a tax credit that s available if you decide to install a solar system.

Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit. You calculate the credit on the form and then enter the result on your 1040.