Solar Panel Credit 2018 Irs

Make sure you have enough tax appetite to use the federal itc against your total taxes.

Solar panel credit 2018 irs. A total combined credit limit of 500 for all tax years after 2005. The solar tax credit expires in 2022. Determine if you are eligible. If the system cost 10 000 the 30 credit would be 3 000 and you could claim a quarter of that or 750.

A combined credit limit of 200 for windows for all tax years after 2005. What is the federal solar tax credit. When you install a solar system 26 of your total project costs including equipment permitting and installation can be claimed as a credit on your federal tax return. And 300 for any item of energy efficient building property.

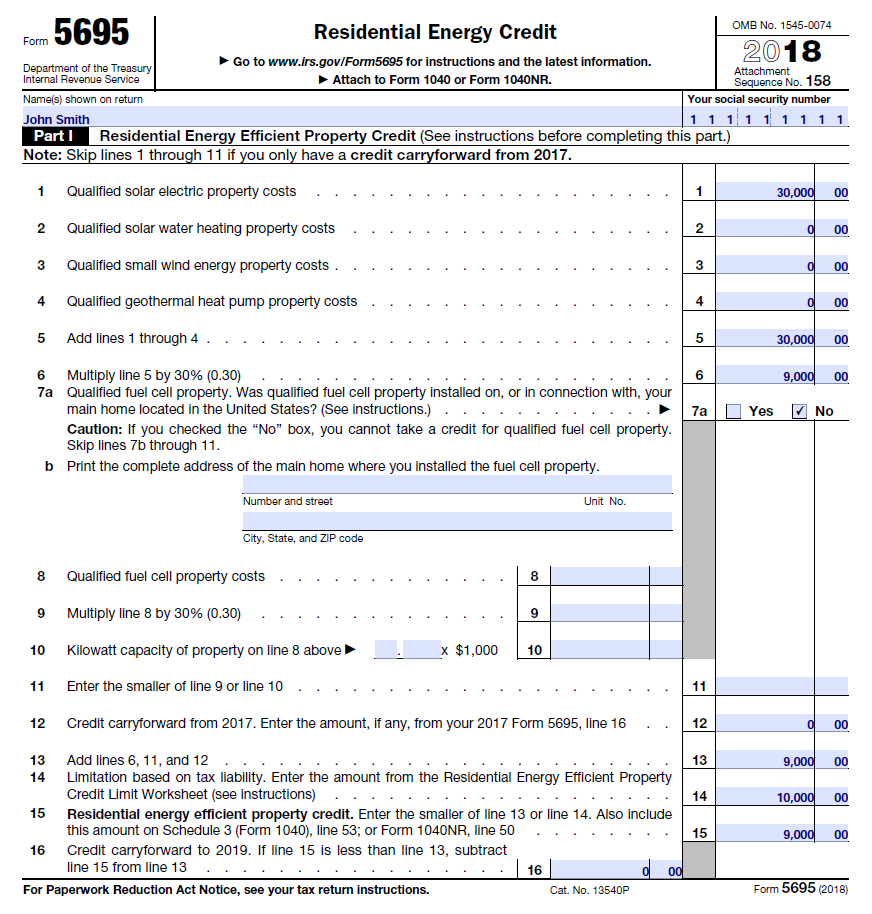

An average sized residential solar. Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit. If you spend 10 000 on your system you owe 2 600 less in taxes the following year. Information about form 5695 residential energy credits including recent updates related forms and instructions on how to file.

Complete irs form 5695. Do not complete part ii. 150 for any qualified natural gas propane or oil furnace or hot water boiler. If you live there for three months a year for instance you can only claim 25 of the credit.

The residential energy credits are. The residential renewable energy tax credit as the irs calls it can be an attractive way to save on the significant cost of installing solar panels or roofing. A credit limit for residential energy property costs for 2018 of 50 for any advanced main air circulating fan. The federal solar tax credit also known as the solar investment tax credit or itc is the single most important solar incentive available in the united states.

In 2018 and 2019 an individual may claim a credit for 1 10 percent of the cost of qualified energy efficiency improvements and 2 the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year subject to the overall credit limit of 500. One of the best incentives that comes along with a solar energy system is the solar investment tax credit itc which allows individuals who purchase a solar system to deduct 30 percent of the cost of the system from their federal taxes. Qualified energy efficiency improvements include the following qualifying products. The itc applies to both residential and commercial solar power systems and there is no cap on its value.

If you install solar panels before the end of 2020 you will receive a tax credit that is equal to 26 of the cost of your solar installation. If you checked the no box you cannot claim the nonbusiness energy property credit.